A Brief Description of Security Tokens vs. Utility Tokens

Mon Sep 24

Reading time: 4 minute(s)

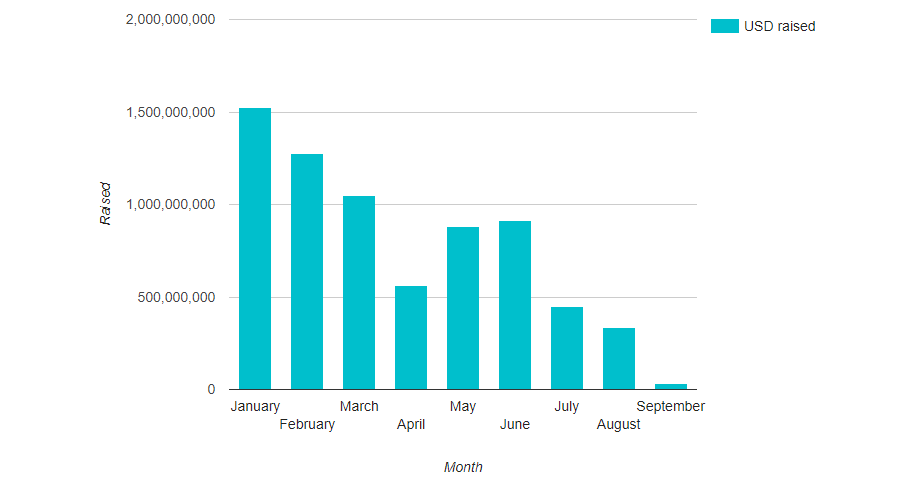

To discover the world of security tokens and utility tokens, one should first understand what exactly their role is and when they come into action; according to official stats, so far, 2018 was a good year for ICOs with a market value of almost $7 billion – context in which it has all the resources to become a multi-trillion dollar industry. ICOs are using the fundraiser model and raising a significant capital through the delivery of crypto tokens that are based on the Blockchain.

The issued tokens can be sent to various wallets (if issued) or traded on the accepting cryptocurrency exchanges. Such tokens can be used for a large variety of services or even entitling buyers to company shares. Some tokens can show a number of files saved in it (Filecoin), user’s deposit in US dollar (Tether), show the buyer’s reputation inside the system (Augur) or even help you purchase premium VPN services (IPSX).

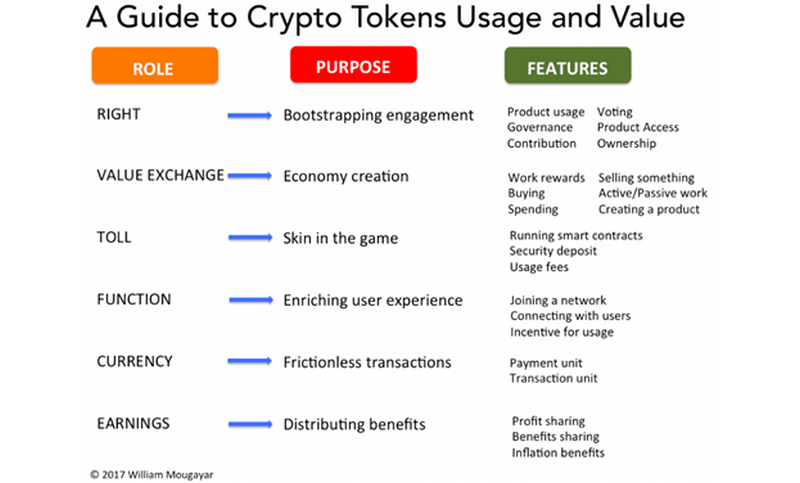

Tokens, on the larger scale, should have one or more functions, like:

– A system, product or service payment method

– A currency, adopted and used throughout the participants of the same payment system

– A digital good (like any propriety or asset but in a digital version)

– A contributor’s reward (platforms like Steemit have already implemented such method)

– Resources for accounting (as in the example given above)

– Entitling investors in company dividends

Depending on their functions, the issued tokens can be either security tokens or utility tokens.

What are Security Tokens?

Security tokens are basically an investment contract and the main purpose of investing in the ICO. This category is made of those crypto tokens whose value is being externally determined from a tradable asset and therefore is subject to various federal securities regulations (the SEC, for example). The bylaws can vary, depending on the country where the token is issued, but refusing to respect these regulations could make the company subject to severe financial penalties or even delay/cancel the whole project.

To be called a security token, the crypto-token must pass the Howey test. Based on this test, on startup will know if it meets all the regulatory obligations and if it has the potential to be used in a various number of ways, which should represent the company’s shares, services or products.

What about Utility Tokens?

Utility Tokens are the friendlier ones as they basically entitle future access to a product and could be compared to a software license, early access pass or even gift card. Also, the tokens that don’t succeed in passing the Howey test are automatically classified as utility tokens.

They are already known as “gateway tokens” and they should:

– Give owners the right of using the issuing crypto network

– Owners could get other benefits like a voting benefit or different roles within the project

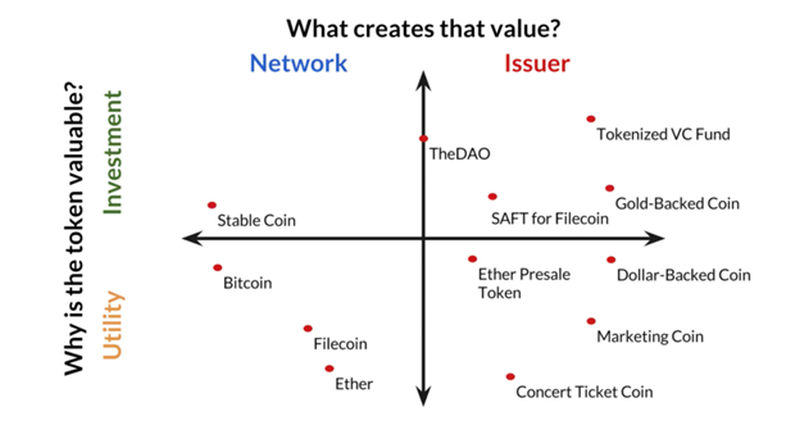

Here is a brief graph example on how a utility or security token is becoming more valuable according to the reasons that are doing so:

On an emerging cryptocurrency where tens of ICOs are launched on a daily basis, choosing a security token is recommended as it will grant you access to a verified platform, various digital goods as well as other rewards from shares or staking. Utility tokens are a simple way and could be a good choice for a small first investment.

Why not learn more about crypto trading and start crypto trading, on a secure, verified website like BitCanuck? Registration takes only a few minutes, and the customer support is ready to help 24/7.